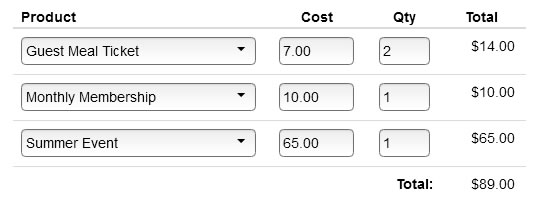

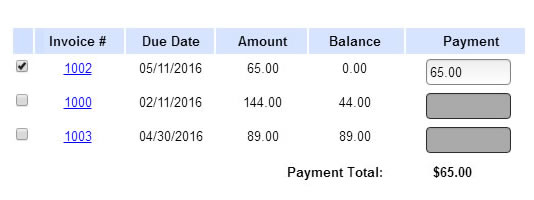

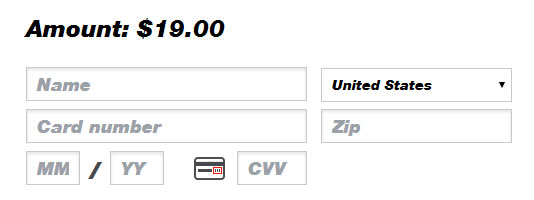

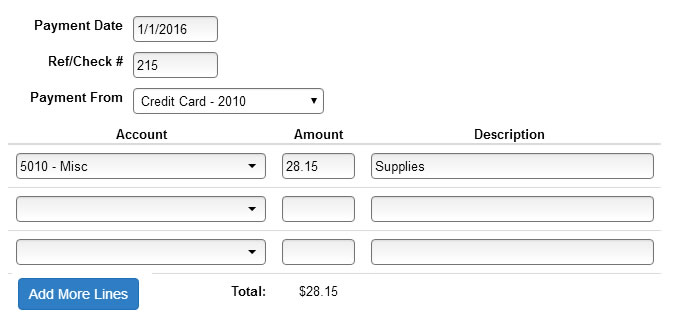

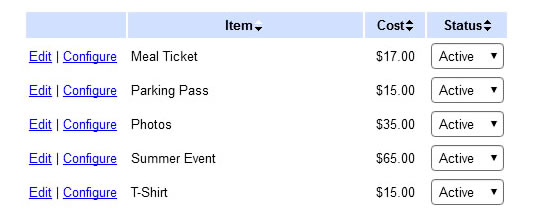

It wasn't that long ago that people would carry a camera, a phone, a checkbook and wait to get home so they could check their email on their desktop computer. Unfortunately, many neighborhoods have the same inefficiency when administering financials, invoices and payments. With Faith Sites, members enjoy the convenience of viewing their invoices through your website. Members also make payments through your same website. Even better, these transactions automatically create accounting entries and update your financial reports. No more external links and separate logins to third party payment providers. No more dealing with interfaces and exporting data as you try to keep systems in sync. This is the realization that makes you more efficient and allows us to automate your tasks that matter most.